The federal government has taken steps to digitalise all forms of government revenue from January 1, 2026, signalling one of the most sweeping public finance reforms the country has witnessed in recent times.

The Drum Reporter reports that the Office of the Accountant General of the Federation (OAGF) has issued a series of circulars to Ministries, Departments, and Agencies (MDAs) spelling out new rules, timelines, and sanctions for non-compliance.

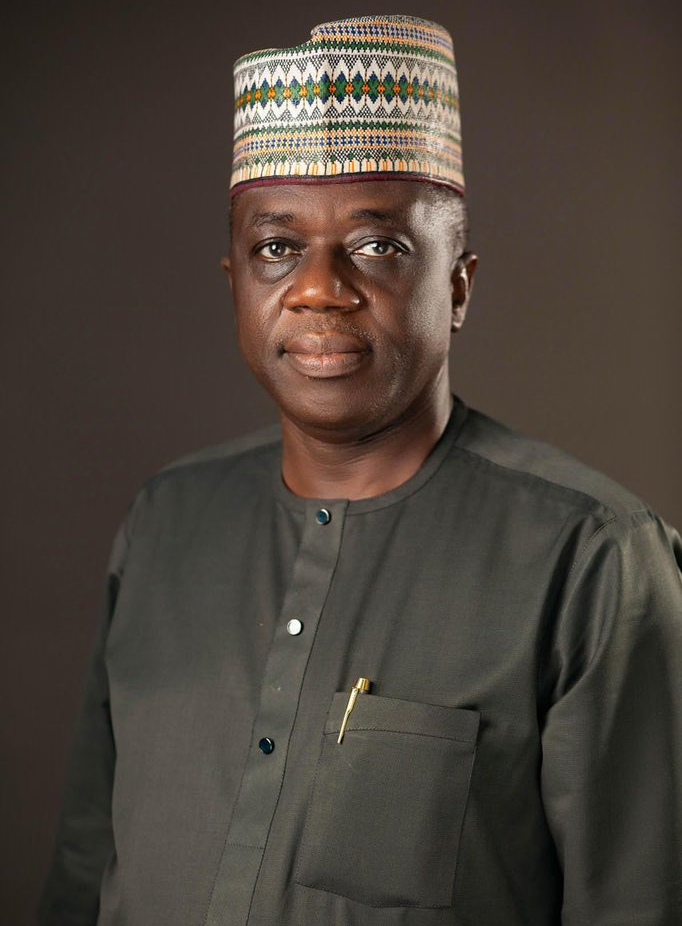

In the first circular titled “Enforcement of ‘No Physical Cash Receipt’ Policy” and dated November 24, 2025, the Accountant General of the Federation (AGF), Dr. Shamseldeen Ogunjimi, directed all MDAs to stop the collection or acceptance of physical cash for government revenue.

He stated that “collection and acceptance of physical cash, whether in Naira or other currencies, for any revenue due to the Federal Government is strictly prohibited,” adding that all payments must now be made through electronic channels.

Dr. Ogunjimi explained that physical cash collection by MDAs had continued to violate existing e-payment and Treasury Single Account (TSA) policies, and had weakened the integrity of the government’s revenue systems.

The OAGF then directed MDAs to sensitise staff and the public immediately, and to display notices bearing “No Physical Cash Receipt” and “No Cash Payment” at all payment points.

MDAs currently using cash methods must deploy functional Point of Sale (POS) terminals or approved electronic devices within 45 days. According to the circular, “Accounting Officers will be held personally accountable for any breach arising from their MDAs’ transactions.”